Louisa County Real Estate Tax Rate 2022 . Louisa county is rank 63rd out of. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. All real estate is subject to taxation, except that specifically exempted by state code. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. View important dates for filing taxes and tax rates for louisa county. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment.

from exozpurop.blob.core.windows.net

View important dates for filing taxes and tax rates for louisa county. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. Louisa county is rank 63rd out of. the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. All real estate is subject to taxation, except that specifically exempted by state code. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year.

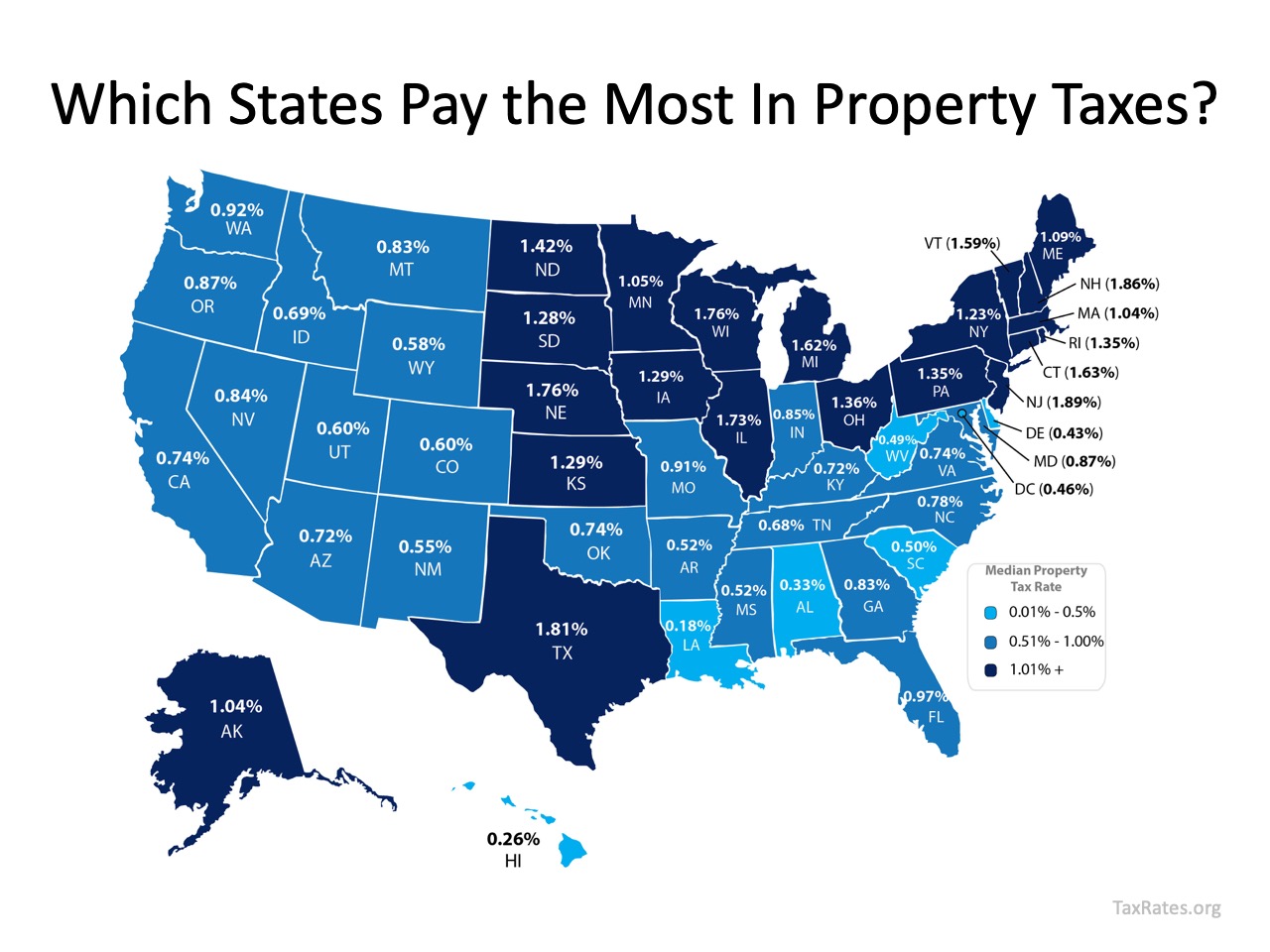

Property Tax Differences Between States at Alfredo Nowak blog

Louisa County Real Estate Tax Rate 2022 All real estate is subject to taxation, except that specifically exempted by state code. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). Louisa county is rank 63rd out of. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. All real estate is subject to taxation, except that specifically exempted by state code. View important dates for filing taxes and tax rates for louisa county. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year.

From 1040taxrelief.com

2022 Tax Rates, Standard Deduction Amounts to be prepared in 2023 Louisa County Real Estate Tax Rate 2022 Louisa county is rank 63rd out of. View important dates for filing taxes and tax rates for louisa county. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. the median property tax in louisa county, virginia is $1,270 per year for a home worth. Louisa County Real Estate Tax Rate 2022.

From exouhtsaf.blob.core.windows.net

Harford County Real Estate Tax Lookup at Frank Rentschler blog Louisa County Real Estate Tax Rate 2022 Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. Louisa county is rank 63rd out of. All real estate is subject to taxation, except that specifically exempted by state code. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a. Louisa County Real Estate Tax Rate 2022.

From www.forsaleatauction.biz

Louisa County VA Tax Delinquent Sale of Real Estate Louisa County Real Estate Tax Rate 2022 View important dates for filing taxes and tax rates for louisa county. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. Louisa county is rank 63rd out. Louisa County Real Estate Tax Rate 2022.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Louisa County Real Estate Tax Rate 2022 All real estate is subject to taxation, except that specifically exempted by state code. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. View important dates for. Louisa County Real Estate Tax Rate 2022.

From donnaqrosemarie.pages.dev

Nj Property Tax Rates By Town 2024 Alfy Louisa Louisa County Real Estate Tax Rate 2022 Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. louisa. Louisa County Real Estate Tax Rate 2022.

From exozsjyud.blob.core.windows.net

Highest Property Taxes In Ohio at Edward Cortez blog Louisa County Real Estate Tax Rate 2022 tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. the median property tax in louisa county, virginia is $1,270 per year for a home worth the. Louisa County Real Estate Tax Rate 2022.

From www.louisacounty.gov

Tax Map Numbers Louisa County, VA Louisa County Real Estate Tax Rate 2022 Louisa county is rank 63rd out of. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. the median property tax in louisa county, virginia is $1,270 per year. Louisa County Real Estate Tax Rate 2022.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Louisa County Real Estate Tax Rate 2022 the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. Louisa county is rank 63rd out of. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. louisa county (0.66%) has a 13.2%. Louisa County Real Estate Tax Rate 2022.

From www.fity.club

Current Use And Your Property Tax Bill Department Of Taxes Louisa County Real Estate Tax Rate 2022 the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. View important dates for filing taxes and tax rates for louisa county. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). Louisa county is rank 63rd out of. Louisa county bills. Louisa County Real Estate Tax Rate 2022.

From ceavutkf.blob.core.windows.net

San Jose Property Tax Rate 2022 at Athena Lindsey blog Louisa County Real Estate Tax Rate 2022 the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. All real estate is subject to taxation, except that specifically exempted by state code. louisa county (0.66%). Louisa County Real Estate Tax Rate 2022.

From emilyavery.pages.dev

Sales Tax Ohio 2025 Emily Avery Louisa County Real Estate Tax Rate 2022 the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. the median property tax in louisa county, virginia is $1,270 per year for a home worth the median value of $218,600. louisa county (0.66%) has a 13.2% lower property tax than the average of. Louisa County Real Estate Tax Rate 2022.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With Louisa County Real Estate Tax Rate 2022 Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. All real estate is subject to taxation, except that specifically exempted by state code. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). View important dates for filing taxes and tax rates for louisa county.. Louisa County Real Estate Tax Rate 2022.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Louisa County Real Estate Tax Rate 2022 tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). All real estate is subject to taxation, except that specifically exempted by state code. View important dates for filing taxes and tax rates for louisa county.. Louisa County Real Estate Tax Rate 2022.

From orianawingrid.pages.dev

Capital Gain 202424 Neile Winonah Louisa County Real Estate Tax Rate 2022 Louisa county is rank 63rd out of. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. louisa county (0.66%) has a 13.2% lower property tax than. Louisa County Real Estate Tax Rate 2022.

From www.yourgv.com

As values rise, Halifax County real estate tax rates to stay steady Louisa County Real Estate Tax Rate 2022 louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). All real estate is subject to taxation, except that specifically exempted by state code. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. tax's assessment/sales ratio study estimates effective rates of real estate by. Louisa County Real Estate Tax Rate 2022.

From petronellawdaune.pages.dev

Suffolk County Ny Sales Tax Rate 2024 Else Nollie Louisa County Real Estate Tax Rate 2022 louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). View important dates for filing taxes and tax rates for louisa county. Louisa county is rank 63rd out of. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. the median property tax (also known. Louisa County Real Estate Tax Rate 2022.

From exoptvyxp.blob.core.windows.net

What Is The Property Tax Rate In Puyallup Wa at Mark Wilkinson blog Louisa County Real Estate Tax Rate 2022 All real estate is subject to taxation, except that specifically exempted by state code. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home value. Louisa county bills real estate taxes annually, the due date for payment is december 5th of each year. View important dates for. Louisa County Real Estate Tax Rate 2022.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Louisa County Real Estate Tax Rate 2022 louisa county (0.66%) has a 13.2% lower property tax than the average of virginia (0.76%). Louisa county is rank 63rd out of. All real estate is subject to taxation, except that specifically exempted by state code. the median property tax (also known as real estate tax) in louisa county is $1,270.00 per year, based on a median home. Louisa County Real Estate Tax Rate 2022.